Payroll Tax. The tax on businesses for employing staff. Although this tax is was brought in by the Federal Government in the 1940’s, and passed to the states in the 1970’s, it has forever been an unpopular tax for businesses. However, despite this, there is some help available for regional business from the Queensland government.

In a win for regional business, current Queensland Treasurer Cameron Dick has confirmed his government will move to amend the current legislation in order to extend this discount beyond 30 June 2023, keeping in place the 1% discount for an as yet undefined period of time. Furthermore, if you are grouped for payroll tax with a business that may not be eligible (i.e. due to being outside the defined regional areas), the eligibility of the discount is also assessed on each location, meaning you could be entitled to a partial discount for the group.

The current rate of payroll tax for employers is:

- 4.75% for employers (groups) who pay $6.5 million or less in Australian taxable wages

- 4.95% for employers (groups) who pay more than $6.5 million in Australian taxable wages.

In 2019, former Queensland treasurer Jackie Trad announced a payroll tax discount for business in regional Queensland, reducing the payroll tax rate by 1% up to June 2023. In order to be eligible for this discount, the following criteria need to be met:

- your principal place of employment is in regional Queensland; AND

- you pay at least 85% of taxable wages to regional employees.

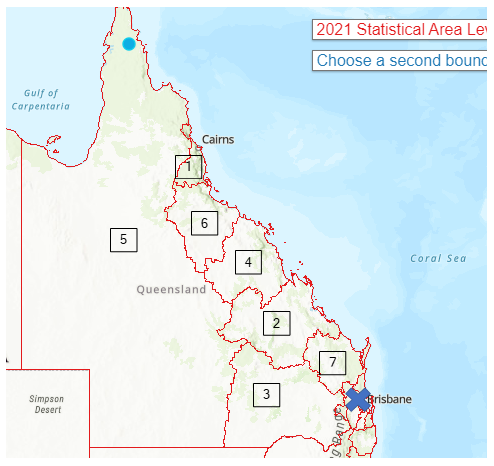

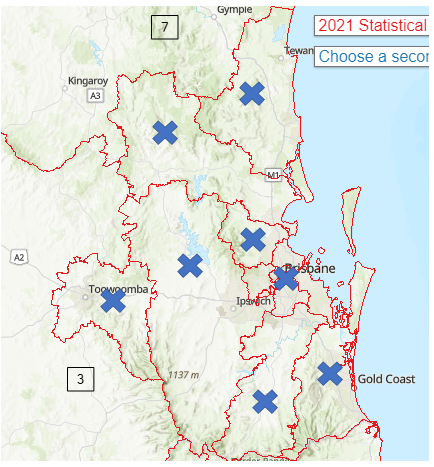

Regional Queensland is defined as those in the following areas (as defined by the Australian Bureau of Statistics 2021 Statistical Area 4 (SA4) map):

- Cairns

- Central Queensland

- Darling Downs Maranoa

- Mackay – Isaac – Whitsunday

- Queensland – Outback

- Townsville

- Wide Bay

Businesses in towns as far reaching as Cairns, Townsville, Gympie, Kingaroy, Hervey Bay, Warwick, Rockhampton, Gladstone, Port Douglas and many more have been eligible for this discount in the past.

At a time of high inflation, increased wage demand and tightening cashflow, this is a small win for regional businesses across the state.

If you have any questions regarding the above, including whether you are in or out of the defined areas or needing assistance when lodging your payroll tax return, contact Director, Steve Gagel at sgagel@prosperity.com.au. Alternatively, you may contact your Principal Adviser to discuss.