In the wake of the Federal Budget consumer confidence has dipped in the quarter to June and our resilient Australian dollar is continuing to make our domestic outlook more difficult than it needs to be. This combined with the tragedy this week in Eastern Europe and escalating challenges in the Middle East makes geopolitical risk to the world higher than it has been of late.

The domestic cash rate remains unchanged at 2.50% and there is no sign of a rise to come in the near term. The Reserve Bank came out in early July and warned that Australians shouldn’t always expect house prices to rise and minutes in mid July indicated they will be holding rates steady until there are significant signs of improvement outside of the mining sector. On the positive, our economy has had moderate growth and there are continued signs that the transition away from mining is slowly occurring with growth in our tourism, oil and gas and property sectors.

Housing construction and new home sales have expanded significantly over the past year, although in the second quarter the pace of increase has moderated a little.

In international markets the US economy has continued to show very positive signs. The US Business output boomed over the month of June – manufacturing output and new orders rose at the fastest pace since April 2010 and job creation hit a four-month high.

A ‘mini-stimulus’ package from the Chinese Government has helped improve economic activity in the region. The Chinese economy has grown at an annual rate of 7.5% in the second quarter, up slightly from 7.4% in the first three months of the year.

The European share market was the only region posting losses in June, with slowed industrial growth.

The Australian bond market continued to perform steadily over the quarter with the UBS Australia Composite All Maturities Index increasing by 3.08%. Within the asset class Government bonds were the stronger performer gaining 3.55%, while corporate bonds increased by 2.57%.

Our economy has had moderate growth and there are continued signs that the transition away from mining is slowly occurring with growth in our tourism, oil and gas and property sectors.

While bonds performed well, Australian equities lost ground in the month of June, recording a loss of -1.45% as measured by the S&P/ASX 300. Over the

entire quarter equities only recorded only a slight gain of 0.88%

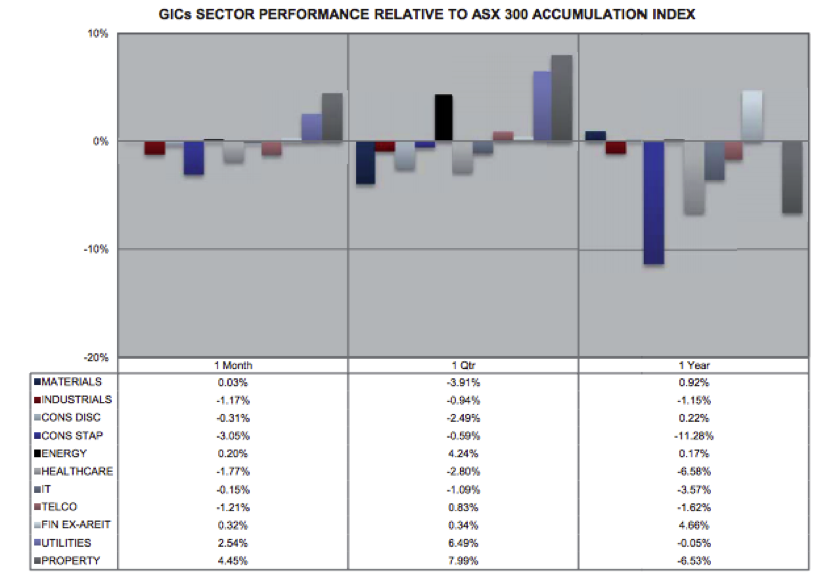

Many sectors reported losses over the month of June, with Consumer Staples and Healthcare deteriorating by 4.49% and -3.21% respectively to be the worst

performers.

Utilities and property were the only sectors posting positive returns in June, gaining 1.09% and 3.00%.

This chart shows GICs Sector performance relative to the ASX 300 Index, over the past 1 month, 1 quarter and 1 year time periods.

In better news, Australian Listed Property has had an exceptionally strong quarter with the S&P/ASX 300 Property Accumulation Index increasing by 9.04%.

Australian Listed Infrastructure also performed very well with the S&P/ASX 300 Utilities Index rising by 5.55% for the quarter.

Gold prices jumped by 6.21% over the month of June after two months of disappointing growth with a loss of -3.24% in May and 0.59% in April.

Oil prices have expanded over the quarter achieving results of 3.00% in June, 3.09% in May and decreased by -1.44% in April.

Over the coming months we will be carefully watching the following:

- The property industry which has showed strong activity in recent months right down the east coast is bringing a lot of apartments to market. The valuations on settlement of these will be critical to sustained growth in the property sector;

- Geopolitical activity in the Ukraine and Israel will be watched closely for spillover into world market confidence; and

- Improvements in both the employment market and consumer confidence which will start to show signs that the interest rate environment could be bottoming.