Embarking on a new long-term relationship is exciting, especially for individuals emerging from a relationship breakdown or the loss of a partner. Often in organising their new life together, the couple may underestimate the importance of preparing an estate plan to reflect their changed circumstances.

Michelle

The adviser recommends for both Peter and Michelle to implement binding death benefit nominations on their respective superannuation funds which will give them certainty that the trustee must pay the benefit to their nominated beneficiary.

The adviser highlights the importance for Michelle to make a nomination in her Will for a legal guardian of Susan until she turns 18 years of age.

After the discussions with their adviser and solicitor, Peter and Michelle implement:

The example is illustrative only and is not an estimate of the investment returns you will receive or fees and costs you will incur.

In the following scenario, we have explored necessary requirements to ensure specific wishes can be actioned for a combined family arrangement.

About the family

Although married for the past 5 years, Peter and Michelle have not completed death benefit nomination forms for their respective superannuation funds. Their current situation is:

Although married for the past 5 years, Peter and Michelle have not completed death benefit nomination forms for their respective superannuation funds. Their current situation is:

Peter

- Medical practitioner

- 60 years old and looking forward to retiring shortly.

- Peter has two adult children from a previous marriage who both live independently - Sally and Brad

- Sally aged 32, is a primary school teacher and married for one year with no children.

- Brad aged 29, has been in a de-facto relationship for six months and runs his own landscaping business.

- Peter currently has $2,000,000 in his superannuation fund and plans to live off the earnings from this asset in his retirement years

- Marketing consultant

- 54 years old and wants to work for another 10 years.

- Michelle has a daughter from a previous marriage - Susan who is 12 years of age.

- Susan lives with Michelle and Peter in the family home.

- Michelle is currently earning $120,000 per annum and has $400,000 in her superannuation fund, plus has life insurance cover of $800,000 which is owned through her superannuation fund.

Their Estate Planning goals

Peter and Michelle share their estate goals with a financial adviser to develop a planning strategy.

- Peter wants his assets to pass through to his two children (Sally and Brad) given he believes that in the event of his death, Michelle would be able to continue working and provide the necessary financial support for Susan. Peter is concerned that his daughter’s marriage is on ‘shaky grounds’.

- Michelle wants her assets to pass through to her daughter Susan. She is concerned about who would look after Susan in the event of her death.

Apart from the family home, the majority of Peter and Michelle’s wealth is held within the superannuation environment. The adviser explains that upon death, superannuation assets generally do not form part of an estate and they would need to specifically nominate where they would like their superannuation to be paid. Additionally, they have not made nominations on their superannuation funds and there is a risk that the trustee of the fund will determine who will receive their benefit, which may not be in accordance with their wishes.

The adviser recommends for both Peter and Michelle to implement binding death benefit nominations on their respective superannuation funds which will give them certainty that the trustee must pay the benefit to their nominated beneficiary.

Given both Peter and Michelle would like to pass their estate through to their own surviving children, the option of nominating the estate to receive the superannuation death benefit is highlighted as well as the potential benefits of incorporating a testamentary trust provision into their respective Wills.

The benefits of a testamentary trust for Peter and Michelle include:

The benefits of a testamentary trust for Peter and Michelle include:

- A reasonable degree of asset protection in the event of a marriage or de-facto relationship breakdown in any of the family relationships, also in the event of bankruptcy. Peter can see the importance of asset protection given his concerns with his daughter’s marriage, and because his son runs his own business.

- The ability for the trustee to distribute income and capital from the trust in an optimal manner to manage overall tax and the ability to distribute income to children under the age of 18 at adult tax rates. Michelle’s daughter would be able to receive up to $21,595 per annum without paying any tax. Michelle understands that this will significantly benefit her daughter in the event of her death.

- The ability to specify an age at which Michelle’s daughter will be able to access capital from the testamentary trust.

The adviser highlights the importance for Michelle to make a nomination in her Will for a legal guardian of Susan until she turns 18 years of age.

After the discussions with their adviser and solicitor, Peter and Michelle implement:

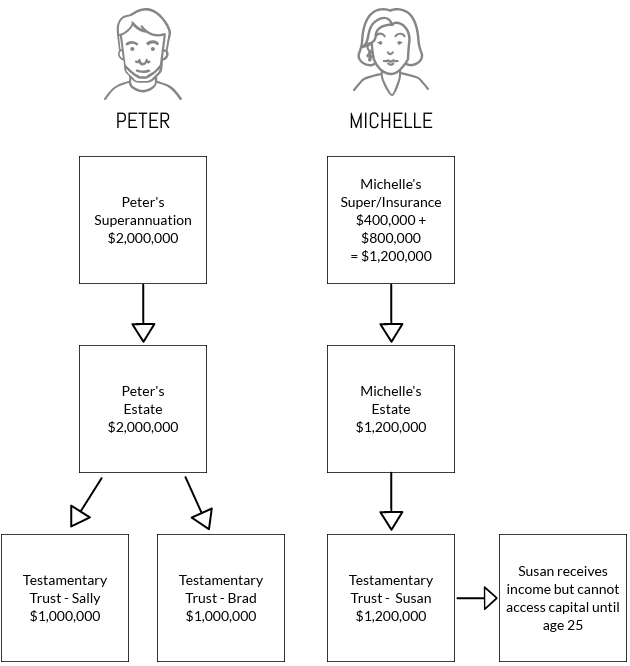

- Peter makes a binding superannuation death benefit nomination payable to his estate so that in the event of his death he has absolute certainty that the $2,000,000 held in his superannuation fund will pass to his estate. He also sets up separate testamentary trusts for Sally and Brad. Peter is comfortable that his assets will pass through to his children with a high degree of certainly, and also tax effectively via a testamentary trust.

- Michelle also makes a binding superannuation death benefit nomination to her estate so in the event of her death both her superannuation balance and life insurance cover totalling $1,200,000 will pass through her estate and to a testamentary trust for the benefit of her daughter, Susan. Michelle feels an element of comfort knowing that her daughter will not be able to withdraw capital from the trust until she reaches the age of 25. Michelle also incorporates into her Will the nomination of her sister to be the legal guardian of Susan in the event of her death.

For more information about your Estate Planning needs please contact Gary Dean on 1300 795 515 or mail@prosperityadvisers.com.au.

The example is illustrative only and is not an estimate of the investment returns you will receive or fees and costs you will incur.

This example is based on the following assumptions:

(a) Have a 50% share each in the family home and have no debts;

(b) Doesn’t take into consideration the taxation implications of Peter and Michelle’s Superannuation being paid to their children;

(c) Tax calculations are based on 2018/19 income tax rates;

(d) Susan will qualify for the low income tax offset of $445 and the low & middle tax offset of $200.

Prosperity Wealth Advisers Pty Ltd (ABN 32 141 396 376), Authorised Representative and Credit Representative of Hillross Financial Services Ltd, Australian Financial Services Licensee and Australian Credit Licensee 232 706.

If you no longer wish to receive direct marketing from us you may opt out by calling us on one of the phone numbers listed below. You may still receive direct marketing from AMP as product issuer, bringing to your attention products, offerings or other information that may be relevant to you. If you no longer wish to receive this information you may opt out by contacting AMP on 1300 157 173.

(a) Have a 50% share each in the family home and have no debts;

(b) Doesn’t take into consideration the taxation implications of Peter and Michelle’s Superannuation being paid to their children;

(c) Tax calculations are based on 2018/19 income tax rates;

(d) Susan will qualify for the low income tax offset of $445 and the low & middle tax offset of $200.

Prosperity Wealth Advisers Pty Ltd (ABN 32 141 396 376), Authorised Representative and Credit Representative of Hillross Financial Services Ltd, Australian Financial Services Licensee and Australian Credit Licensee 232 706.

If you no longer wish to receive direct marketing from us you may opt out by calling us on one of the phone numbers listed below. You may still receive direct marketing from AMP as product issuer, bringing to your attention products, offerings or other information that may be relevant to you. If you no longer wish to receive this information you may opt out by contacting AMP on 1300 157 173.