It is that time of year when accountants are all saying that it is that time of year: tax planning. The rush of activity before the big 30 June cut-off date. This should of course always be part of a longer term strategy and thought-out well in advance, however changes in circumstances and the rules dictate that we should take stock at this time each year.

Here are some things small business and individuals may want to consider in the run-up to 30 June:

For everyone:

1. Deposit into super

As with all years, to get the deduction for yourself or your staff, you need to have made the payment into super prior to 30 June. Also, individuals need to make a payment to super before year end to access the $100,000 non-concessional contribution cap. The government co-contribution up to $500 for additional deductible contributions into super should also be considered. 30 June falls on a Sunday this year, so contributions need to be made well before the prior Friday.

2. Time sale of capital assets

Postpone sales of assets with gains, bring forward asset sales with underlying losses. This can include shares and also depreciable assets for businesses.

3. Donations

The tax reward for donations comes a little faster when paid at this time of year.

4. Car repairs

If you claim a car for work under the log book method, or have one in your business, having the annual service done and possibly new tyres before year end will bring forward a tax deduction. Also you should do a log book for 3 months if you haven’t already in the last 5 years.

5. Prepaid expenses

Certain expenses can be prepaid to gain a deduction in the current year, for example subscriptions and memberships, travel expenses, investment property expenses, interest on investment loans, and income protection insurance.

6. June 2019 tax instalment variation

For those on instalments, it may be preferable to vary the instalment down if the 2019 tax position can be reasonably estimated. This can be done after year end but needs to be done before the BAS is due.

For business:

7. Buy a car (or any depreciable asset): Instant asset write-off

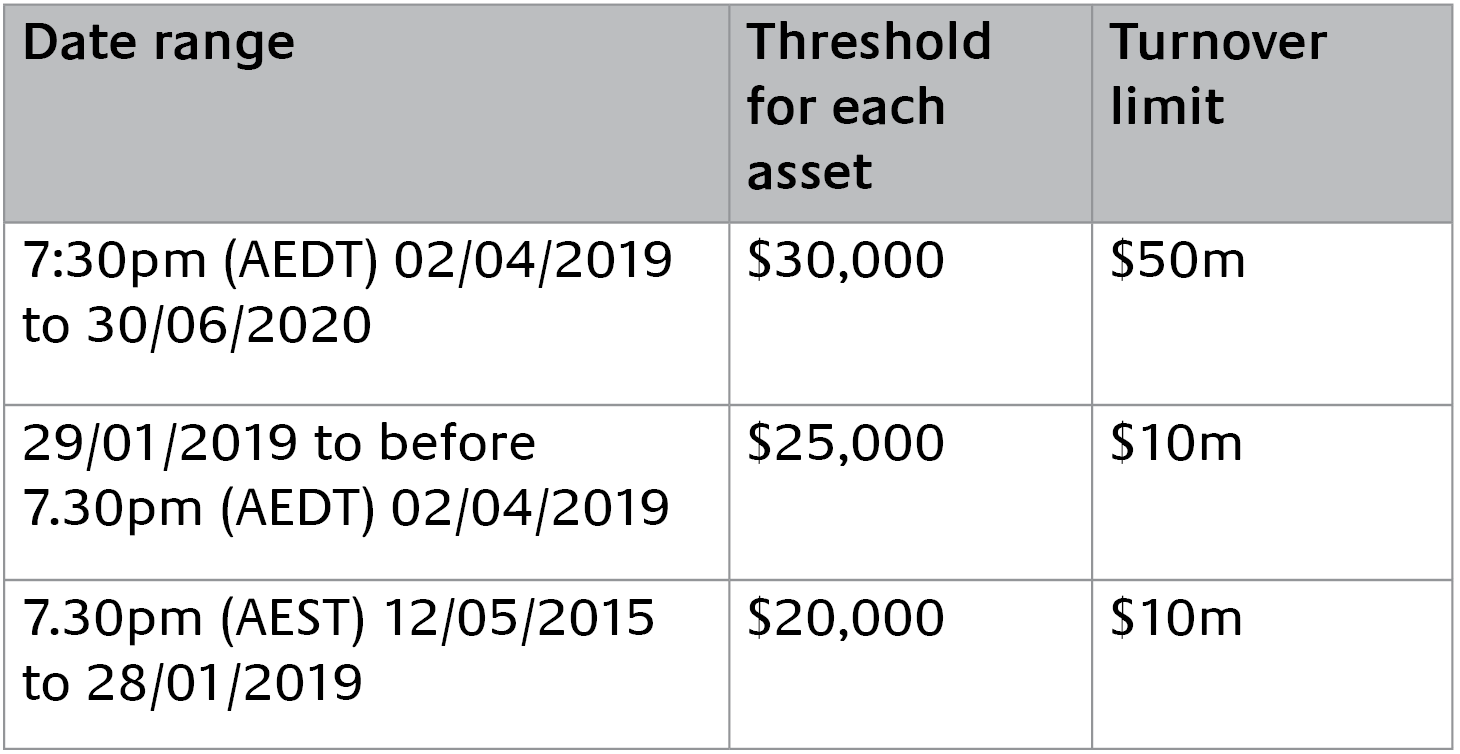

This has been available for many years, but this year it is significantly expanded. Notably for businesses with up to $50m turnover the write-off is now available for the first time. It is the only 2019 budget announcement that has passed into legislation. It provides the opportunity to bring forward significant tax deductions.

When funded by debt, the purchase of a depreciable asset can result in a cash benefit well in excess of the first year’s asset finance repayment. Talk to our asset finance specialist Alex Warian if you are interested.

The amount you can write-off in 2019 is dependent on when the asset was purchased due to a series of announcements this year. If registered for GST, the threshold is exclusive. If not registered for GST then the threshold is inclusive.

8. Consider common business tax planning opportunities

a) Timing of income: defer invoicing business income and identify income that has been received for which services are yet to be performed and remove them from income (treat as a liability).

b) Trading stock: consider valuation/stocktake at year end to justify reduction in total value and in particular any obsolete stock.

c) Prepayments: for SBEs (<$10m turnover), a deduction may be claimed for prepaid expenses less than 12 months in advance, e.g. workers compensation. Prepayments of certain expenses such as wages and interest expenses may also be immediately deducted.

d) Ensure any bonuses are confirmed by resolution before year end if a discretionary element is involved.

e) Review debtors for any bad debts and write-off prior to year-end.

9. Start-up expenses

June is a good month to start up a new business. Small Business Entities and those not yet in business can claim an immediate deduction for legal and accounting advice in relation to the structure of the new business, costs associated with raising capital and government registration fees such as ASIC fees.

For corporates:

10. Do you need to pay a dividend?

This matter should be addressed prior to 30 June if possible. Paying a dividend may be necessary to avoid potentially large tax bills from Division 7A loans taken by shareholders from the company. It is also often necessary to pay dividends in implementing a good tax plan, such as balancing taxable income over years and between individuals. Typically dividends can be declared and applied to loan accounts at year end to avoid the need to pay cash. Caution should be exercised to ensure the franking account has not been reduced below zero for the year, in which case deferral of a dividend should be considered.

11. 80% passive income test to access 27.5% company tax rate

Access to the lower company tax rate can be advantageous for some, but it can also result in trapped franking credits. Steps taken at year end to balance incomes from passive and active sources can mean the difference between being taxed under the lower rate or not. Talk to your advisor regarding what tax rate is preferable for your structure

12. Division 7A loan repayments

If you have the ability to repay a portion of the loan to you from your company this may want to be considered. By repaying part of the loan in cash before year end, it is possible to reduce or eliminate any dividend that would otherwise need to be declared. Reducing the dividend would ultimately reduce the company shareholders taxable income in the current year.

13. Consider an employee share plan

There are multiple tax and commercial benefits that can be achieved through employee share plans. These can be particularly attractive for recent start-ups and companies who have lent significant amounts to existing shareholders. You would need to work fast to get one in place prior to year-end.

For trusts:

14. Trust distributions

Distribution minutes should be prepared prior to year end, particularly if you are “streaming” capital gains or franked dividends to particular beneficiaries.

If you have any questions regarding the above, please contact our Director of Taxation Services Michael Bode on 1300 795 515 or mbode@prosperity.com.au. Alternatively contact your principal adviser.